The Online Business & Startup Course teaches you important aspects about starting a new business from scratch as well as the marketing cycle of defining a product or combination of products and/or services and then going through the processes to assess the viability and market demand for your idea. It is ideal for those starting a business as well as existing businesses who need to re-invent themselves or try something new. The course includes the following topics:

- Exploring margins on products

- How to measure your gross and net profit margins

- Defining strategies to help increase your income and profit margin

- Packaging your services to get the right amount of clients of the right size

- Reducing costs and systemising your business — and much more!

The Online Business & Startup Course provides you with pre-built Excel spreadsheets to help you look at scenarios for initial marketing costs and operational changes from month to month. You will learn how to conduct regular and swift “test and measure” smart reporting. You can completely edit these files and change them as much as you want — they are not locked!

You’ll also learn how to:

- define what you sell so you can explain it quickly

- plan your marketing strategy

- tick off your startup compliance tasks, then

- build a reputation that helps bring in new clients continuously and effortlessly — that’s our goal.

Business Planning Made EZY

Most business owners have a hunch that there are customers out there who need their products and services, but a little preparation and a simple business plan will give you proof and confidence — not only that your business is viable, but a blueprint for how you can achieve your objectives.

The business plan spreadsheet (included in this course) will help you with things like:

- hiring new team members

- buying equipment

- give you confidence to speak with lenders or investors

Smart Reporting — Set Yourself Up for Quick Growth

Often in small business, is the business owner is too busy being the technician to properly manage the business so the business stagnates. The Online Business & Startup Course is designed to help you do more than just start your business; it’s designed to help your business grow.

Included are videos, interviews, workbooks and templates that teach you how to perform regular reports on your business so you can see what’s working and what’s not in order to make the right strategic decisions.

Combine the Online Business & Startup Course with software training and you can use MYOB, Xero or Quickbooks to understand how your business is performing financially and Microsoft Office to manage the office administration tasks.

Topics Included in the Online Business & Startup Course

01 Originate and Develop Concepts

Whether you work in your own small business, or whether you’re working for somebody else, you will probably be required to develop concepts or products. For example, you might have to develop an advertising/marketing campaign, staff development program, a media or IT plan, or organise an event or exhibit.

So what might you do? A good first step is to research existing information and there are various methodologies you can use. For instance, you could identify gaps in the current range of products, programs, processes or services that inform the new concept. You might be thinking about the prospects of future commercialization of your product or concept. You will assess what others in the marketplace are doing and identify some major factors likely to impact on your idea or concept.

Learn more

02 Business Planning

What Are You Going To Sell and to Who?

A Business Plan is used to look ahead, allocate resources, focus on key points and prepare for problems and opportunities.

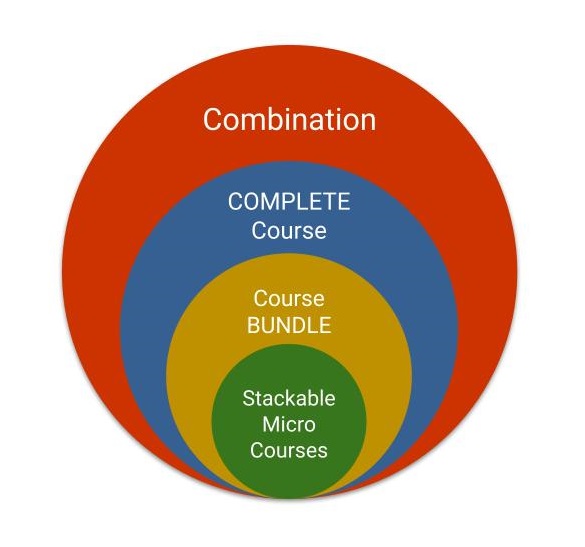

The “Product” goal of this subject is to discover

- what are you going to sell,

- how are you going to package it (bundles, product/service combo, membership etc), and

- how much you are going to sell it for.

You’ll also spent time to discover

- who your ideal customer is,

- who your competitors are, and

- some goals to get you started and into ACTION

Learn more

03 Establish Legal and Risk Management

Protect Yourself And Demonstrate Quality

There are many laws governing small businesses accounting and operations. Some people who look to start a business buy a franchise because most aspects of how the business operates is organised for them but with the right business structure and legal documents in place you can present a professional business with high standards as well as defined the ideal customer and product/service.

In this course you’ll learn about Codes of Conduct, Professional Services Agreements, Work Health and Safety and Privacy Polices. You’ll also explore commercial leases, what to watch out for, what you can use to negotiate and clauses that can give your business flexibility to grow.

Learn more

04 Protect And Use Intangible Assets In Small Business

Most businesses have intangible assets alongside the tangible ones (that is, your computer, your bricks and mortar office, and so forth).

Intangible assets are the ideas and concepts behind your product or service and they lie at the very core of what makes your business unique. They may have a very real market value and they help improve your business performance. One of the best known intangible assets is your brand or trademark and this subject will teach you about trademarks and how to use them and also make sure you don’t infringe on anyone else’s trademarks.

You’ll learn how to:

- Identify what your intangible assets might be and help to value them

- Select the types of protection available for such assets

- Calculate the likely costs, risks and benefits of potential types of protection available

- Avoid infringing upon the intellectual property of others and help you monitor the marketplace to see that the same doesn’t happen to you

- Communicate the importance and nature of the above to all relevant staff members and ensure this information remains privy to only those inside your business

- Identify options for exploiting and commercialising your intangible assets

Learn more

05 Market research & Marketing Message

Market research is essential to business success because it helps you provide your services the way that people want them. When you know what is happening in the market you can position your business strategically to capture the business but most importantly when a potential customer calls you’ll be able to speak with them calmly and confidently about what is included in your services and how much you charge for them.

You must understand:

- The market for the industry you are in

- Who the major competitors are

- How competitors offer their products and services

- Changes have happened recently in competitors as well as in the industry

- Trends that are impacting on your product or service

- Other major participants like technology companies, overseas companies, industry bodies or Government?

- Why someone should buy from you

Think of market research as the information that helps you formulate the combination of services, products and offers for your business. Without it, you may have a short spurt of success but find that potential clients don’t use your services. You may get lots of enquiries but find that very few of them convert to become customers.

Learn more

Xero Accounting COMPLETE Training Course Package

Xero Accounting COMPLETE Training Course Package Microsoft Excel COMPLETE Training Course Package

Microsoft Excel COMPLETE Training Course Package This Xero and Excel Training Course package includes the COMPLETE course for Microsoft Excel and Xero so it comes with a number of FREE Student Inclusions designed to help you achieve your learning objectives.

This Xero and Excel Training Course package includes the COMPLETE course for Microsoft Excel and Xero so it comes with a number of FREE Student Inclusions designed to help you achieve your learning objectives. The training included in this Accounting Course Package is regularly updated and added to and as a student you’ll get access to all updates and additions during your 12 months course access for all these programs.

The training included in this Accounting Course Package is regularly updated and added to and as a student you’ll get access to all updates and additions during your 12 months course access for all these programs. 12 months course access and support is provided as standard but if you need extra time or want ongoing access and support (like if you run your own business) then our VERY low cost Ongoing Course Access and Membership package is very compelling.

12 months course access and support is provided as standard but if you need extra time or want ongoing access and support (like if you run your own business) then our VERY low cost Ongoing Course Access and Membership package is very compelling.

Credit control ensures you understand who owes you money and who you owe money too. Accounts Payable and Accounts Receivable are the main tasks covered in this section of the course and you’ll understand why it is important to understand how long it takes to get paid and to pay your suppliers.

Credit control ensures you understand who owes you money and who you owe money too. Accounts Payable and Accounts Receivable are the main tasks covered in this section of the course and you’ll understand why it is important to understand how long it takes to get paid and to pay your suppliers.

Very widely used and continuously updated since the 1990’s this software made MYOB the dominant accounting software company in Australia and is still used by a large number of established businesses. It is software that is downloaded onto a Windows PC.

Very widely used and continuously updated since the 1990’s this software made MYOB the dominant accounting software company in Australia and is still used by a large number of established businesses. It is software that is downloaded onto a Windows PC. Xero is now a global competitor which competes with Sage in the UK, Intuit (QuickBooks) in the US as well as Canada, South Africa, Ireland, Singapore and many other countries. Xero is just as widely used in Australia as MYOB and they are growing rapidly.

Xero is now a global competitor which competes with Sage in the UK, Intuit (QuickBooks) in the US as well as Canada, South Africa, Ireland, Singapore and many other countries. Xero is just as widely used in Australia as MYOB and they are growing rapidly.

After the initial 12 month access period you can join the EzyLearn Career Courses membership program and continue to access all content and updates for a low annual fee.

After the initial 12 month access period you can join the EzyLearn Career Courses membership program and continue to access all content and updates for a low annual fee.

Data Entry is one of the most time consuming tasks for junior level bookkeepers and it is the cause of:

Data Entry is one of the most time consuming tasks for junior level bookkeepers and it is the cause of: MYOB In tray

MYOB In tray

Job applications for

Job applications for  ou perform office support jobs in finance and accounting data entry into Excel spreadsheets is a vital skill and as the world’s leading spreadsheet program, Microsoft Excel is also used in marketing, capital raisings, reporting and so many aspects of work that it’s a must have for everyone from junior office staff (including school leavers) and office admin staff.

ou perform office support jobs in finance and accounting data entry into Excel spreadsheets is a vital skill and as the world’s leading spreadsheet program, Microsoft Excel is also used in marketing, capital raisings, reporting and so many aspects of work that it’s a must have for everyone from junior office staff (including school leavers) and office admin staff. When the job you’re applying for requires some basic graphic design skills you’ll be able to demonstration that with confidence in using Microsoft PowerPoint. Presentations are used to aid a speaker but also to provide concise snapshots of information to present financial results, products and services and even to pitch to get new customers.

When the job you’re applying for requires some basic graphic design skills you’ll be able to demonstration that with confidence in using Microsoft PowerPoint. Presentations are used to aid a speaker but also to provide concise snapshots of information to present financial results, products and services and even to pitch to get new customers. Save time and confusion by using Microsoft Outlook to manage correspondence, information sharing and calendar appointments. Microsoft Outlook enables office support staff, receptionists and executive assistants to organise their managers, sales staff or clients appointments and planning to ensure that everything runs smoothly.

Save time and confusion by using Microsoft Outlook to manage correspondence, information sharing and calendar appointments. Microsoft Outlook enables office support staff, receptionists and executive assistants to organise their managers, sales staff or clients appointments and planning to ensure that everything runs smoothly.

Setup and configuration of the

Setup and configuration of the

Journal entries,

Journal entries,

Hubdoc

Hubdoc