We’d like to help you find work or customers for your own bookkeeping business

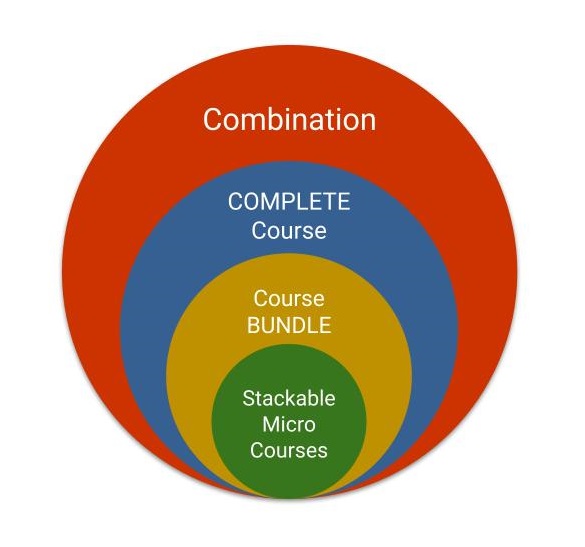

When you enrol into our MYOB Training Course and choose the Lifetime option and Certificate you can create a profile in our MYOB Bookkeeper Directory at no cost.

We’ve introduced a number of initiatives that students told us are important to them and one of the biggest has been to help then earn money. Some want to find work as an employee others want to find clients for their own small home based businesses.

How does Bookkeeper Directory Work?

The Bookkeeper Directory is designed to help bookkeepers find employers and employers find bookkeepers. It’s a matching service that is simple to use and is a proven way of connecting two people who need each other.

Create a Profile

The first step is that you create a bookkeeping profile (you can do this once you have completed our online MYOB, Xero & QuickBooks Training Course and received your Certificate).

Simply fill in the form to create your bookkeeper profile outlining your bookkeeping skills, experience and preferred working conditions.

We will then syndicate (distribute) this information via a number of different online websites and channels, as well as via our Partner companies to make your information known.

Working with Small Business

We work closely with small businesses which have provided us with a position profile of their requirements, including the ideal skill set and experience level of the candidates they are looking for, as well as the conditions and pay they want to offer (including part-time/casual work) and match applicants as appropriate.

Our Students; Our ‘Talent Pool’

These bookkeeping position profiles are submitted among our students, or talent pool, and we then seek applications for everyone who would like to apply for the position. We make sure that all members understand the standards of work required and also provide training on how to perform to our code of conduct.

You are in good company

Most students who complete our MYOB, Xero & QuickBooks Training Courses are either looking for work as an employee, or want to start their own business.

Some of our students are:

- Mums returning to the workforce

- Corporate accountants who want to work more flexible hours and be closer to home

- People looking to find reliable work,

- People who want to find work close to home

At a recent career expo we attended we were amazed to discover that potential MYOB bookkeepers were evenly scattered around Sydney. We’ve also discovered that the desired work patterns of our students vary. For instance, some are looking for:

- Full-time work

- Permanent part-time work

- Casual work

What are Companies Looking For?

Small businesses are the biggest employers in Australia and they come in all shapes and sizes. Some are business start ups who need someone to manage the financials while they get on with the business they’re passionate about. Some companies are established but still small and flexible, while others are going through their growth stages.

Bookkeeping is a requirement for every company. The data entry for Day-to-Day Transactions, Bank Reconciliation, Payroll and Reporting is required by every business to satisfy their obligations to the Australian Taxation Office (ATO). Small businesses need bookkeeping to be compliant!

Data Entry and Coding

Data entry for Day-to-Day Transactions is one of the most time-consuming tasks for small business, yet everything else is dependent upon it. An important aspect of data entry is ensuring that all of the transactions are allocated to the correct category (or account in the chart of accounts) — you don’t want to mix up revenue with an inter-company transfer, for example. We’ve discovered that most business have the same, or very similar, transactions each month so once a pattern is established this type of work is quite repetitive but most entry level bookkeepers can do it.

End-of-Period Reconciliation and Reporting

This type of work involves ensuring the computerised data matches the bank statements and can be submitted for end of month or end of quarter reporting. This work can often involve discovering errors in the data entry like dates or amounts. This stage is also important to enable a small business to lodge their Business Activity Statements (BAS).

Our Bookkeeping Training Course Content is regularly updated

When you are an EzyLearn student your course access includes updated and newly created content during your membership period. This means that you’ll never need to pay for another MYOB course.

EzyLearn’s online Bookkeeping training courses comes with the assurance of a 30-Day money-back guarantee.

You’re Supported in Search of Bookkeeping Work

Support is an important aspect of doing anything new and we have a team of people who are not only dedicated to your online training experience with EzyLearn but want to help you find bookkeeping work.

We have a dedicated Bookkeeping Directory Coordinator who will help match you to the most appropriate employer.

When you opt to register for directory membership you’ll become part of a community of people from all over Australia (and even internationally) who have similar goals.

Together we can provide well priced bookkeeping services and training using Australia’s most popular accounting software – MYOB, Xero & QuickBooks – to thousands of small businesses around the country.

Bookkeeping Induction

Even when we operated our Sydney training centres in Dee Why, Gordon and Parramatta our MYOB courses were taught using real life scenarios to give students experience in using the MYOB software with examples from existing businesses. The training workbooks (which currenctly number 10) enable you to work through practical step-by-step examples using the actual software (we provide you with a source for a free download).

Our Bookkeeping short courses include training material that takes you through an bookkeeping induction for:

- Setting up a business,

- Operating a products and serviced based business that buys products and then sells them to customers with added services, and

- Serviced based businesses like a bookeeping business, remote contractor or website developer

- The process of employing and paying someone and reporting on the Super and other tax obligations for that person

- End of period reporting like BAS, End of Month and End of Year.

- Process of buying an asset and depreciating that asset over it’s useful life

Did you know…

Lot’s of our students are actually business owners who need help with their bookkeeping but don’t want to pay exorbitant fees for a bookkeeper. satisfaction.

Come on a personal development journey and find ways to help local businesses with their bookkeeping while getting regular work close to home.

Sincerely,

Steve Slisar

(Managing Director)