This list of accounting and office administration position descriptions show a logical career progression for jobs in this industry.

- Data Entry & Word Processing Jobs

- Office Support & Office Administration Jobs

- Receptionist, Secretarial, PA & Executive Assistant Jobs

- Accounts Receivable / Accounts Payable Officer Jobs

- Customer Service, Client Support and Sales Administration

- Payroll Officer Jobs

- Accounts Administrator jobs

- Office & Business Administration Jobs

Data Entry, Word Processing & Records Management Jobs

Data Entry Jobs are considered the entry level office jobs because they focus around the use of Office software and entering data into computer systems.

Data Entry jobs are centred around the entry, accuracy, integrity and the use of that data and systems that manage that data.

Although data entry jobs are considered as entry level jobs there are some industries, such as funds management and superannuation where the information is very important and confident and requires extra skills.

Data Entry, Word Processing & Records Management Job Descriptions & Courses

Office Administration & Office Support Jobs

Data entry and Office Support jobs are found in most businesses with 3 staff or higher because the work involves helping to co-ordinate and support the work performed by different staff members as well as the administration, filing, customer service and reporting for the business owner.

These jobs are popular with mums and parents and are a good entry point as they don’t often required very specialist knowledge and experience so they can be performed after completing a short course or vocational certificate courses.

Common tasks for this type of job are:

- Data entry of work order information

- Customer service via phone or email

- Preparing and maintaining spreadsheet data

- General administration duties

- Filing of paperwork and digital files

- Maintaining office supplies

- Assisting with and updating daily, weekly and monthly reports

- Assisting management, accounting and administration teams

- Exposure to beginner level knowledge of accounting software

Most these skills can be learnt in our Microsoft Office and Accounting Courses

The best courses for skills and practice examples for data entry, reception and office junior types roles are based on solid skills in Microsoft Word and Excel.

Office Administration & Office Support Job Description & Courses

Accounts Receivable / Accounts Payable Officer

Accounts receivable and payable officers perform two very different, yet important, functions in a business; rarely, are the two roles performed by the same person.

Accounts receivable officers manage the payments coming into a business — invoices, sales receipts, customer payments; while the accounts payable officer is responsible for all outgoing payments — payments to suppliers and vendors and all other outgoing expenses.

Credit Management Jobs

The two roles generally fall within a company’s credit management framework — that is, the process and procedures set up to manage a business’ cash flow, including how and when the business is paid, and how and what the business spends its money on.

Sometimes these procedures are divided between the two roles (i.e., chasing late-payers would be the responsibility of the accounts receivable officer); other times, a credit manager will oversee the credit management policy within the business (i.e., assessing customers’ credit worthiness, managing customer credit files, investigating credit issues, liaising with collection agencies).

Tasks of an accounts receivable officer:

- Records, verifies and enters customer payments in accounting software

- Reconciles accounts receivable ledger

- Prepare customer / client statements, invoices and bills

- Follow-up on outstanding / overdue customer statements, invoices and bills

- Implement customer payment plans where appropriate

- Coordinate contact with collections agency where appropriate

- Prepare reports and perform other administrative duties.

Tasks of an accounts payable officer :

- Review, verify and pay invoices from suppliers and vendors

- Verify vendor and supplier accounts by checking ABN and ACN numbers

- Disburse petty cash by recording the entry, verifying documentation

- Arrange payment plans with suppliers and vendors where appropriate

- Prepare reports and perform other administrative duties.

Best courses for Accounts Payable and Accounts Receivable Jobs

The best skills to have to be confident in applying for these junior accounting roles are based around the most popular accounting programs used in Australia (MYOB, Xero and QuickBooks Online).

See our Accounts Receivable and Accounts Payable Training Courses

Payroll Officer

The role of a payroll officer sits within the accounts team, though their tasks and duties are distinctly different to the accounts receivable / payable officer or credit manager’s. The payroll officer may, however, work with a company’s human resources department, especially with regard to onboarding new hires and offboarding department employees.

Tasks of a payroll officer:

- Process all payroll transactions based on employee timesheets and employment contracts

- Collect and update employee information to maintain payroll records

- Compile summaries of earnings, taxes, deductions, leave entitlements, disability, and non-taxable wages

- Resolve payroll discrepancies

- Calculate payroll liabilities, such as payroll tax, workers’ compensation payments, etc

- Prepare reports and perform other administrative duties.

See our Payroll Administration Training Courses

Accounts Administrator job description

An accounts administrator is responsible for a company’s entire accounting work, including bookkeeping, invoicing, and payroll. In some organisations, the accounts administrator fills a managerial role, overseeing the business’ bookkeepers and other accounting staff.

An accounts administrator will typically be tertiary educated, holding at least a bachelor’s degree in finance, accounting or other relevant field, and have a minimum of five years experience in a similar role.

The accounts administrator role is typically broken up into four key areas — although, as explained earlier, it may serve as a managerial role, overseeing these key areas.

Accounts receivable

- Records, verifies and enters customer payments in accounting software

- Reconciles accounts receivable ledger

- Prepare customer / client statements, invoices and bills

- Follow-up on outstanding / overdue customer statements, invoices and bills

- Implement customer payment plans where appropriate

- Coordinate contact with collections agency where appropriate

- Prepare reports and perform other administrative duties.

Accounts payable

- Review, verify and pay invoices from suppliers and vendors

- Verify vendor and supplier accounts by checking ABN and ACN numbers

- Disburse petty cash by recording the entry, verifying documentation

- Arrange payment plans with suppliers and vendors where appropriate

- Prepare reports and perform other administrative duties.

General bookkeeping and account administration

- Bank reconciliation

- Update cash flow schedule and monitor cash flow requirements

- Foreign currency payments (if any)

- Monthly reconciliation of general ledger accounts as required

- Analysis of general ledger accounts to assist with annual budgeting process

- Assist with the preparation of the annual budget

- Update invoice and billing templates in account software

- Input annual price changes to fee and services in accounting software

- Assist with general accounting and other administrative duties as required

- Provide information to external auditors as required.

Payroll Administration

- Process all payroll transactions based on employee timesheets and employment contracts

- Collect and update employee information to maintain payroll records

- Compile summaries of earnings, taxes, deductions, leave entitlements, disability, and non-taxable wages

- Resolve payroll discrepancies

- Calculate payroll liabilities, such as payroll tax, workers’ compensation payments, etc

- Prepare reports and perform other administrative duties.

Accounts administrators must have a thorough understanding of most accounting packages, such as MYOB, Xero and QuickBooks; while it may also help to understand more complex systems, such as Greentree and other enterprise reporting programs.

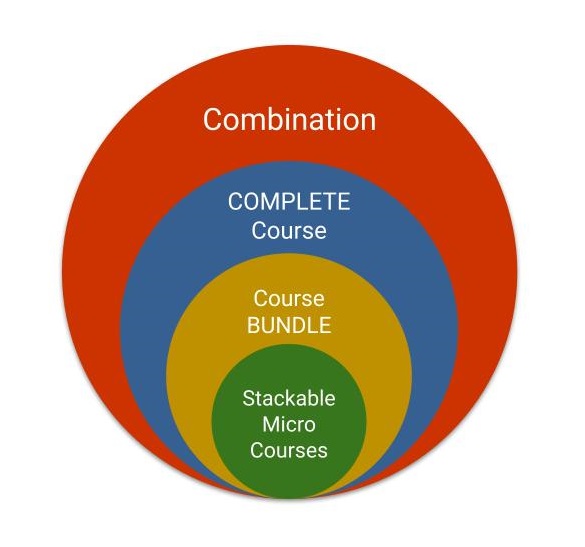

See Accounts Administrator Training Courses and Packages

Office & Business Administrator job description

An office administrator (sometimes called an office manager) ensures that all the administrative activities within an organisation are running efficiently, sometimes by overseeing and supervising other employees within the business.

The office administrator may oversee and be responsible for the management of human resources, budgets and business or financial records. These responsibilities will differ depending on the employer and education level of the office administrator.

Some roles that overlap with the office administrator role include:

- Receptionists, who are responsible for greeting clients and suppliers, providing customer service, managing and maintaining the office filing system, sorting mail, and other general administrative duties, such as maintaining office supplies and equipment

- Personal assistants, who provide secretarial and administrative support to a senior stakeholder in the business — the chief executive, managing director or other C-level employees.

The typical tasks of an office administrator include:

- Accounting tasks, such as invoicing, budgeting and general bookkeeping

- Scheduling and arrangement meetings and travel and accommodation for senior executives

- Prepare and setup for meetings, including the provision of refreshments and catering

- Ordering office supplies and equipment

- Onboarding and training new employees in correct WHS procedures

- Overseeing the building maintenance, such as engaging tradespeople and cleaning services

- Collect and verify employee timesheets for the payroll officer

- Filing and other administrative tasks, such as sorting mail, receiving and arranging deliveries.

Typically, an office administrator will have previous experience in a senior finance role, but may have previous experience in an entry-level position, such as an administrative assistant, receptionist or personal assistant.

See Certificate in Business Administration Training Courses

Job Search

Click the link below to find all office admin and support jobs at Seek and narrow your search down by geographic area to find something close to home.